The Dividend Aristocrats Starter Pack

What the pros might buy if they had to build their portfolio from scratch

Even the best investors have to start somewhere

If you lost everything today, would you know how to rebuild?

That’s the thought experiment Barron’s posed—indirectly—when they published this year’s Roundtable stock picks.

The list included high-conviction names from some of the most respected investors in the game.

And what stood out wasn’t what was new.

It was how many picks were old, proven, and quietly compounding in the background.

What pros are buying at all-time highs

The S&P 500 just hit fresh records.

AI stocks are still roaring, and everyone’s watching the Fed for rate-cut timing.

Yet many Roundtable pros named stocks like PepsiCo, Johnson & Johnson, NextEra Energy, and Procter & Gamble.

These companies won’t 5x next quarter.

But they’ve raised their dividends for 25+ years—and kept doing it through recessions, tech bubbles, and inflation spikes.

That’s what makes them Dividend Aristocrats.

And that’s why they still show up in professional portfolios—even after decades.

What it says about long-term investing

Momentum wins headlines.

But consistency builds wealth.

The pros know that dividend growth isn’t just about income.

It’s about discipline, durability, and staying power.

Dividend Aristocrats aren’t just “safe stocks”—they’re a mental model for how to think.

They force you to ask: “Would I still want to own this 10 years from now?”

That kind of clarity is rare—and valuable.

How to apply this to your own portfolio

- Build your base with durable payers

Start with companies that have a 25+ year record of raising dividends—not just paying them. - Favor boring over flashy

If it solves everyday problems and has pricing power, it belongs on your watchlist. - Use dividends as a behavior tool

Reinvesting dividends can keep you grounded when prices get noisy. - Balance growth with ballast

Pair high-growth bets with steady cash generators—so you're not leaning too far into either. - Track payout discipline, not just yield

A high dividend is meaningless if it’s unsustainable. Focus on consistency over size.

A question to sit with

If you had to rebuild your portfolio from scratch… would you choose what you already own?

The real edge isn’t speed—it’s staying power

Dividend Aristocrats may not impress your group chat.

But they’ll show up year after year, compounding quietly while others chase trends.

If you’re looking to build a more resilient foundation, this is a good place to start.

Because starting over doesn’t mean starting from zero.

It means starting with clarity.

– Choose companies with 25+ years of dividend growth

– Prioritize consistency over hype

– Reinvest dividends to stay grounded

– Pair growth with cash-flow ballast

– Focus on payout strength, not just yield

Strategies Worth Watching

Outsmarting the Hidden Forces That Move Markets

Ever wondered why some trades go south the moment you enter?

You're not imagining it.

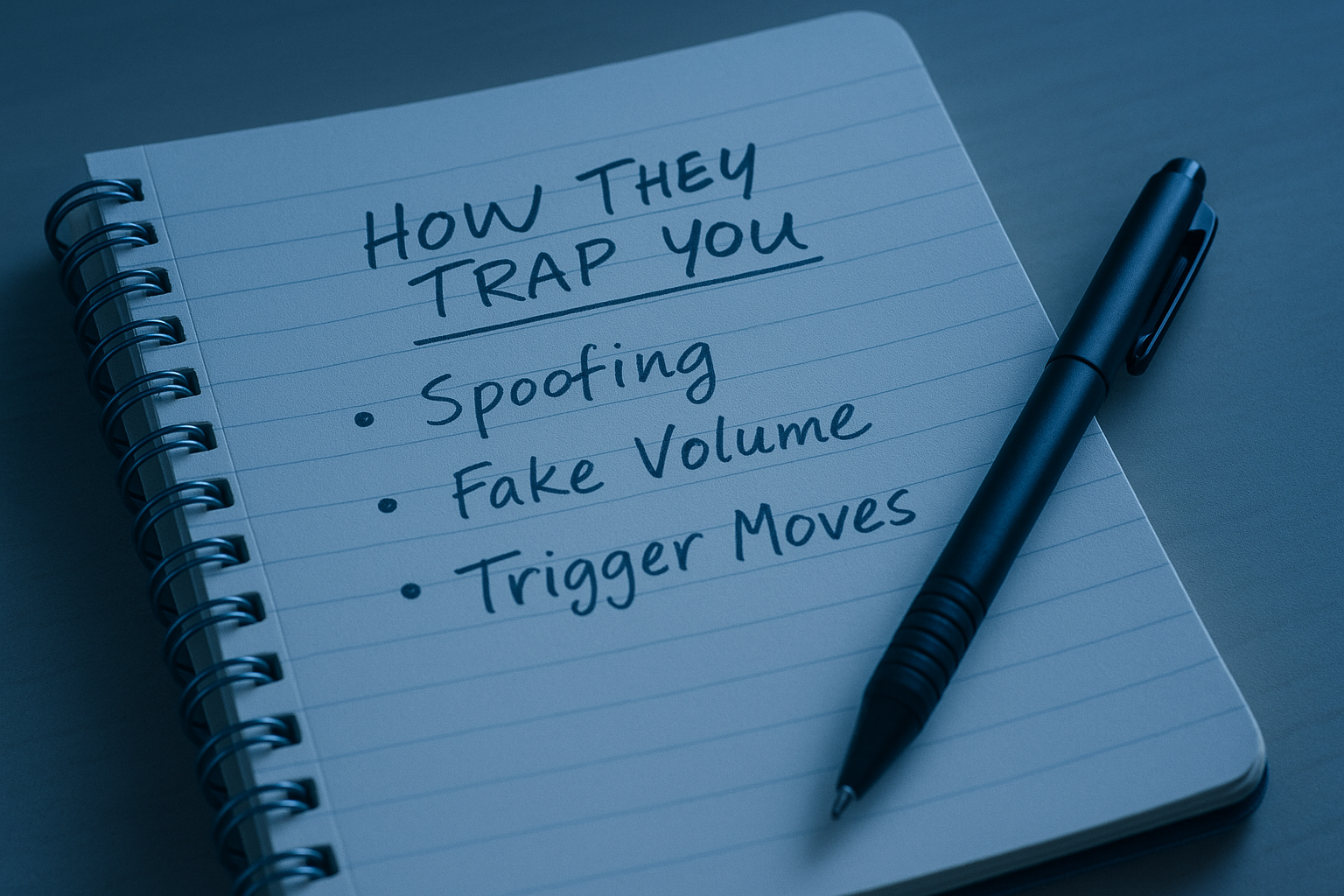

Two powerful forces shape market moves—often at the expense of retail investors.

Super Investor Club breaks them down and shows you how to defend your portfolio.

You’ll uncover:

✅ How market makers profit from your trades (and how to avoid their traps)

✅ The psychology behind spoofing, pump-and-dumps, and manipulation tactics

✅ Why emotional trading and poor execution cost small investors more

✅ Real-world case studies like the Flash Crash and Citadel’s 2020 windfall

✅ How to trade with intention—not reaction

Whether you're an active trader or a long-term investor, understanding these dynamics will help you protect your edge.

👉 Start your free 2-week Super Investor Club trial and build smarter habits

P.S. No commitments. Just sharp, practical insights—and a better way to navigate the market.

More Tools for Your Journey

Balance Short-Term Moves with Long-Term Goals

It’s tough to know what to focus on right now.

The market pulls you in with fast-moving headlines.

But your bigger goals need a steadier hand.

Curated newsletters help you zoom out without losing the present.

They show how near-term ideas can still fit a long-term plan.

You’ll see the difference between chasing trends and building toward something.

And start investing with clearer priorities, not just instincts.

Explore smarter investing signals, this shortlist might help.