Shifting Coordinates: Finding Opportunity as Market Maps Redraw Themselves

When familiar trends fade, new directions quietly appear.

The Market’s Quiet Recalibration

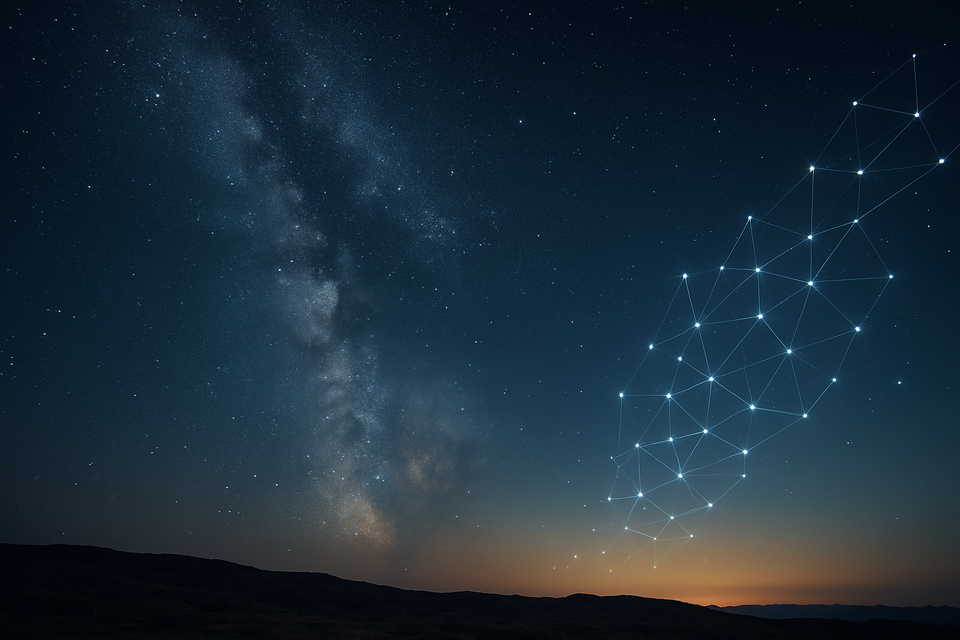

Every bull market draws its own constellation — bright names burning at the center, smaller ones flickering at the edge.

But as one set of stars fades, another quietly comes into view.

This is how leadership changes in markets: not in headlines, but in hints — valuation cracks, fund-flow whispers, and strength surfacing where no one’s looking.

The story of 2025 isn’t that markets are cooling.

It’s that markets are redistributing energy — and investors who can read the map early will find where momentum is migrating next.

💡 Decoded Insight: Maps don’t stay still — and neither does leadership. When attention clusters, opportunity drifts to the edges.

From Heat to Humility

After two years of headline-driven exuberance, the largest U.S. names are running on belief as much as earnings.

By the Rule of 20 (forward P/E + CPI), the S&P 500 sits in the mid-30s — well above long-term fair value near 20, a sign of stretched expectations rather than crisis.

It’s not panic territory; it’s crowded altitude.

When expectation outpaces delivery, every new high carries more hope than proof.

That tension — between greatness achieved and growth already priced in — is how market eras quietly turn.

💡 Decoded Insight: Exuberance rarely ends with a crash; it ends with a pause. Pauses are where new opportunity gathers strength.

The Quiet Migration of Money

Fresh adviser surveys show allocations shifting toward small caps and emerging markets while enthusiasm for U.S. mega-caps cools.

A recent poll found about 60 % bullish on Australian small caps, 57 % on global small caps, and 53 % on EM — nearly double April’s readings.

This isn’t retreat; it’s re-routing.

Liquidity is widening, volatility has eased, and capital is exploring neglected corners of the map where expectations — and valuations — are lighter.

💡 Decoded Insight: Money rarely leaves markets; it learns new directions to travel.

The Unlikely Beneficiaries

While AI still owns the headlines, its bottleneck is power.

Data centers are ravenous for electricity, pushing upgrades across the grid — a tailwind for utilities and power producers that’s helped the group outpace even Big Tech this year.

These aren’t speculative moonshots; they’re the plumbing of the digital economy, monetizing steady demand from an innovation wave they didn’t start but now sustain.

💡 Decoded Insight: Every revolution needs someone to keep the lights on.

What Breadth Is (Still) Telling Us

Rallies look glamorous when a few giants do the lifting — and brittle, too.

Recent notes flag narrow market breadth despite index strength: only a minority of S&P members are beating the benchmark, a classic sign the advance is concentrated.

Treat any broadening in Industrials, Financials, or Materials as confirmation the foundation is strengthening.

Meanwhile, the ongoing U.S. government shutdown adds a layer of data-release uncertainty — the kind that can jolt sector leadership as investors adapt to delayed signals.

💡 Decoded Insight: Breadth is the market’s immune system. When it widens, recoveries turn durable.

Turning Signals into Strategy

Information is abundant; clarity is the new edge.

Here’s how to translate these shifting coordinates into positioning that moves with the market — not after it.

1. Re-draw Your Exposure Map

Balance away from crowded leaders; re-introduce under-owned areas.

- Small-Caps & Cyclicals: IWM, VSS, XLI, XLF

- Emerging Markets: VWO, EEM, INDA (India), EWY (Korea)

- Infrastructure & Utilities: XLU; NEE, DUK, PCG; PAVE

(Examples only; size based on risk, timeframe, and current allocation.)

2. Follow Earnings Breadth, Not Price Highs

Track the number of companies beating expectations within each sector.

Sustained improvement often leads performance by a full quarter.

3. Blend Curiosity with Caution

Keep some ballast — defensives or short-term cash — to fund new ideas as they confirm.

In late-cycle markets, adaptation beats conviction.

💡 Decoded Insight: Opportunity hides in the in-between — between fear and fatigue, between what’s known and what’s next.

A Question to Sit With

If every market cycle redraws the map,

will you wait for the chart — or start exploring before it’s published?

Closing Thought

Leadership doesn’t vanish; it migrates.

Investors who follow that migration — without nostalgia or panic — don’t just survive new cycles.

They navigate them.

Because the market rarely changes direction;

it simply finds new ways to keep moving forward.

Partner Spotlight: Find Freedom as the World — and Markets — Move

Every market cycle redraws its map. Leadership shifts, momentum migrates, and opportunity shows up where few are looking. The same is true for how we live — the moment you step outside familiar coordinates, new paths quietly appear.

That’s why I recommend Nomad for Less.

It’s the go-to newsletter for people who want to work and travel anywhere in the world — without overspending. Each issue brings you remote job listings, flight deals, and practical travel hacks, showing you how to explore more while spending less.

It’s not just about travel — it’s about building a lifestyle that’s flexible, curious, and financially smart.

With more than 70,000 digital nomads and remote professionals already subscribed, it’s become a trusted hub for those who want freedom without the guesswork.

👉 Join Nomad for Less here — and start discovering how to see more of the world while keeping your savings intact.