S&P 500 Hits 6,000—But That’s Not the Number That Matters

The market crossed a milestone—but your retirement plan needs something stronger than headlines.

A Milestone That Can Mislead

The S&P 500 briefly broke through the 6,000 mark this week.

A big, round number. A moment that felt historic.

But just hours later, it slipped back under—reminding us how fragile momentum can be.

For long-term investors, especially those planning for retirement, the noise can feel deafening.

What’s Really Happening?

Yes, markets are up. But so is uncertainty.

Valuations are stretched across tech and consumer discretionary stocks.

Yields on 10-year Treasurys remain elevated near 4.45%, limiting the appeal of stocks for cautious investors.

And inflation remains sticky, pushing the Fed to hold off on expected rate cuts.

In short: what looks like a surge might just be a stall.

Why This Matters for Retirement Savers

It’s tempting to see headlines like “S&P 6,000” and think, Did I miss the rally? Should I get in now?

That mindset pulls you away from the actual goal: building a reliable, durable retirement plan.

Milestones are psychological, not financial.

Reacting to them often leads to emotional investing—chasing highs, panicking at lows.

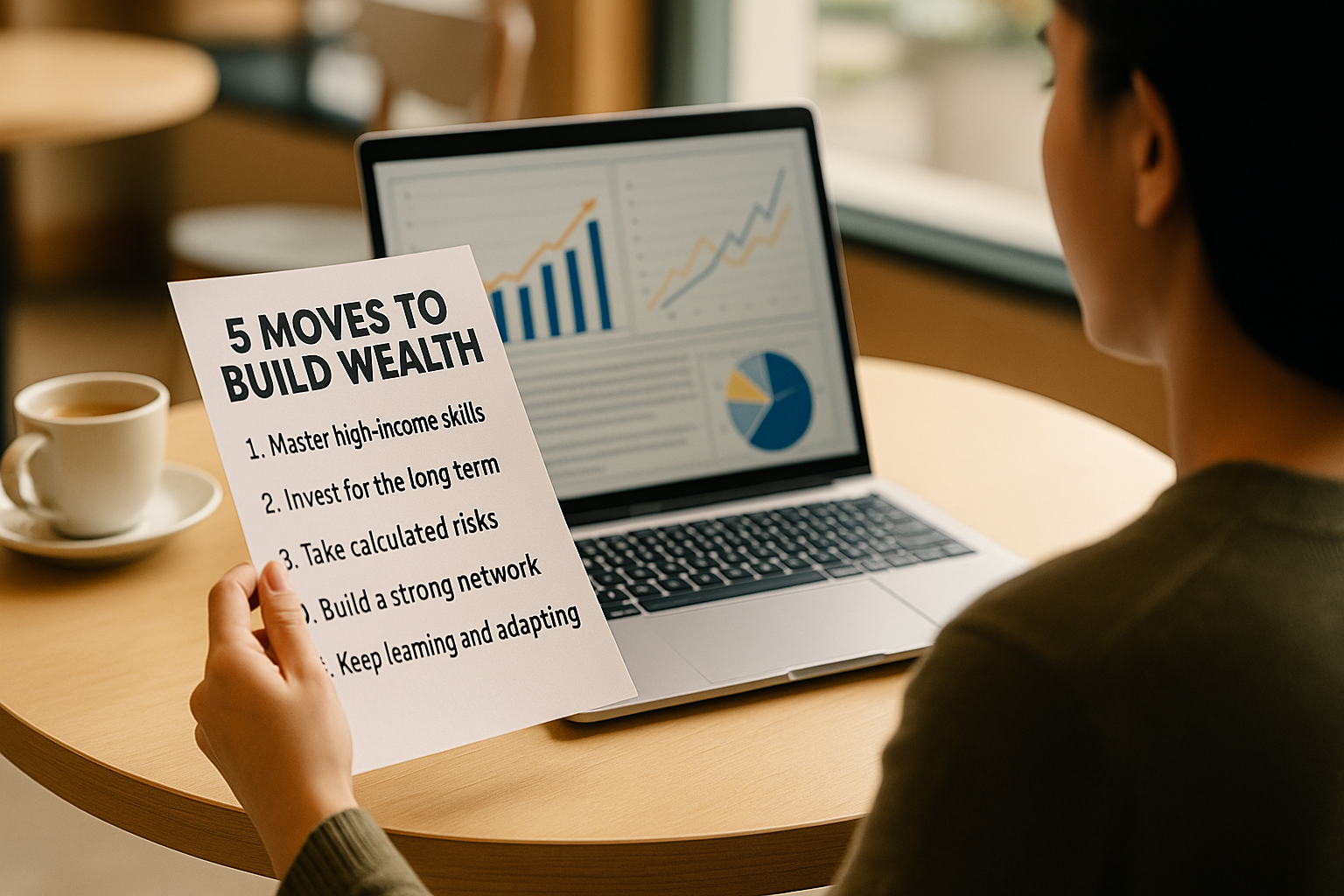

5 Moves to Stay Grounded and Grow Your Retirement Plan

- Commit to your long-term timeline

Retirement isn’t a reaction—it’s a roadmap. Know the horizon you’re working toward, and invest accordingly. - Automate your contributions

Consistency beats intensity. Auto-deposit into your retirement accounts reduces decision fatigue and builds discipline. - Avoid anchoring to headlines

“S&P 6,000” sounds impressive, but it doesn’t change your risk tolerance, time horizon, or financial needs. - Diversify beyond what’s trending

Tech is hot, but don’t forget value stocks, global equities, and inflation-protected bonds. Retirement portfolios need ballast. - Revisit your assumptions annually

As markets shift, inflation lingers, and rates stay high, make sure your retirement math still works—without overhauling everything.

“S&P 500 touched 6,000—but valuations are significantly above long-term averages.”

Are You Planning Ahead—Or Reacting Late?

Have recent milestones made you feel like you’re behind?

Or made you question your current approach?

That gut reaction is common. But planning is always stronger than chasing.

The Best Time to Start Was Yesterday. The Next Best Time Is Today.

Retirement planning doesn’t need to wait for a calm market or perfect moment.

What it needs is clarity, patience, and a steady path forward.

Big headlines might move markets—but your future depends on something quieter:

A plan you trust. And the habit of sticking to it.

Strategies Worth Watching

From $0 to $1 Million: What Smart Investors Actually Do

Building wealth in the markets doesn’t start with luck.

It starts with preparation—and a smarter plan.

The Super Investor Club breaks down five real-world moves that have helped everyday investors build serious momentum.

It’s not about shortcuts. It’s about learning what actually works—and applying it consistently.

Inside, you’ll discover:

- High-income skills that fund your investing journey

- How to make compound interest work harder for you

- Why calculated risks early on can change your future returns

- Where to find the kind of network that accelerates your growth

- How to keep your strategy sharp in a fast-changing market

No jargon. No overwhelm. Just clear, repeatable steps to grow your capital and invest with confidence.

🔗 Explore the Super Investor Club and start your free 2-week trial

P.S. You can try it commitment-free. For many, just one smart trade has covered the cost.

More Tools for Your Journey

Tired of Buying High and Regretting It?

It’s easy to get swept up when stocks are surging—buying high feels safe in the moment, until it isn’t.

That’s where curated newsletters come in.

They offer a steady voice when markets get loud, helping you stay grounded in strategy, not emotion.

Over time, they teach you to spot patterns, not just price spikes.

If you’ve been chasing rallies and regretting the timing, this shortlist might help.