Earnings Season: What the Numbers Don’t Tell You

Why strong results can hide weak signals — and what investors should really listen for

When Euphoria Meets Evasion

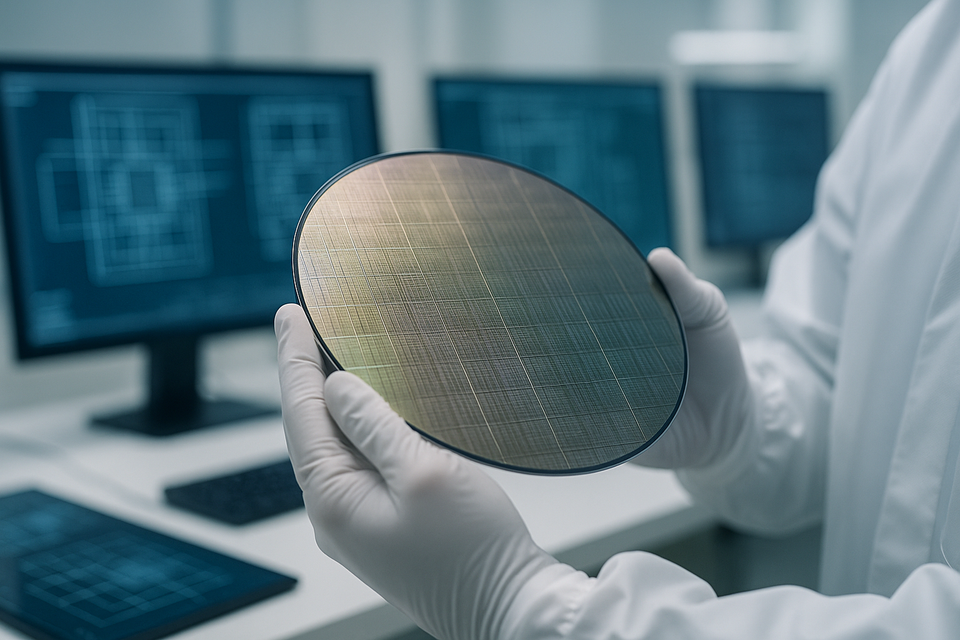

TSMC just posted record-high earnings — a 39% jump in profit fueled by insatiable AI-chip demand.

Banks, meanwhile, are minting money from trading and deals — yet warning of bubbles in the same breath.

The scoreboard looks great, but the subtext feels uneasy.

It’s a classic earnings-season paradox: when numbers peak, honesty often retreats.

Between cautious guidance, overconfident forecasts, and carefully choreographed calls, investors must learn to read tone as closely as they read tables.

💡 Decoded Insight: What’s said in earnings season moves prices; what’s unsaid shapes conviction.

The AI High: Profits Without Pause

TSMC’s blockbuster quarter confirms that AI’s hardware boom is still accelerating — gross margin near 59.5% (above guidance), and management admits it must “narrow the gap” between demand and capacity.

The company also raised its full-year revenue growth forecast to the mid-30% range, signaling that AI’s supply chain remains red-hot.

Yet investors should remember: exponential narratives often flatten suddenly once capacity catches up.

Behind every “beat and raise” lies a test of realism — can earnings momentum survive normalization, or is it running on scarcity and story?

💡 Decoded Insight: Exponential trends build belief faster than fundamentals; stay anchored to cash flow, not headlines.

Bankers’ Double Speak

Goldman Sachs and JPMorgan told investors: profits strong, outlook bright — but markets “show signs of over-exuberance.”

They’re selling confidence and caution at once, a balancing act that mirrors retail investors’ own psychology.

Executives praised dealmaking momentum while warning that select assets look stretched, threading the needle between optimism and restraint.

When executives hedge optimism, they’re not confused — they’re managing expectations.

It’s a reminder that guidance isn’t just a forecast; it’s an emotional instrument designed to temper both fear and greed.

💡 Decoded Insight: Guidance is marketing in a suit — learn to hear the motive behind the metric.

The Sound of Silence on Earnings Calls

A new study finds that when CEOs dodge questions, analyst forecast errors widen and post-announcement volatility spikes.

Silence, it seems, is a signal too.

Investors often over-weigh the numbers but under-weigh the voice delivering them.

Next time you read an earnings transcript, note what isn’t answered — that gap is often where risk hides.

💡 Decoded Insight: In markets, omission is communication — absence of clarity is a form of guidance.

Retail’s Surprise Cheer

Dollar Tree surprised investors with high-teens EPS growth projected for 2026 and a 12–15% compound growth rate through 2028 — a sharp turn from earlier caution.

It’s not just a retail story; it’s a mood swing.

After months of muted consumer sentiment, one confident forecast reignites FOMO and momentum chasing.

Earnings optimism spreads faster than inflation data — because it feels personal.

When small-ticket retailers turn bullish, retail investors often follow emotionally, not analytically.

💡 Decoded Insight: Optimism is contagious — protect your process from its infection.

A Question to Sit With

When you read an earnings report,

do you seek truth in numbers — or comfort in narrative?

Closing Thought

This season’s record profits tell one story.

The manner in which they’re told reveals another.

Markets move not just on math but on meaning — tone, confidence, silence, and surprise.

Learning to decode those layers turns quarterly noise into enduring insight.

Because in investing, the numbers inform you —

but the signals between the numbers prepare you.

Partner Spotlight: Read the Signals Behind the Tech Headlines

Every earnings season has a rhythm — hype first, honesty later. You hear the numbers, but the story often hides between the lines. Tech headlines are no different: they can move markets overnight, but only the informed know which ones actually matter.

That’s why I recommend Techpresso.

In just five minutes a day, Techpresso helps you stay sharp on the most important AI and technology news — not just what’s trending, but what’s transforming industries. Each edition cuts through the noise to deliver concise, curated insights that investors, founders, and professionals use to connect today’s news with tomorrow’s opportunities.

With more than 400,000 readers from Google, Apple, and OpenAI, Techpresso has become a trusted daily read for those who want clarity without overwhelm.

👉 Subscribe to Techpresso here — and start reading tech news the way smart investors read earnings reports: for the signals that others miss.