Bonds Are Back—But Not How Most Think

Why rising noise makes Bond ETFs more valuable—not less

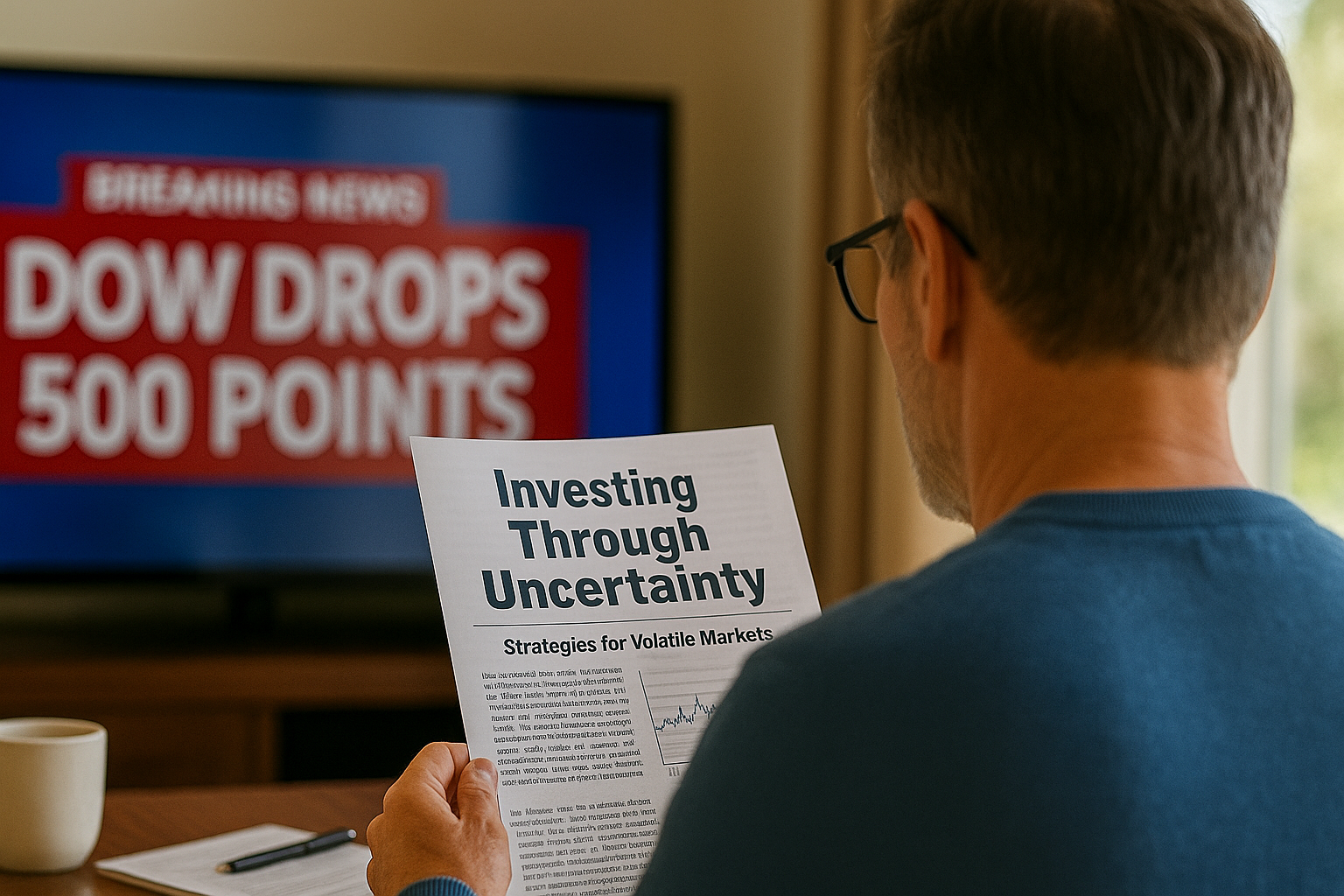

The Real Risk Isn’t Missing the Rally—It’s Misreading the Safety Net

Inflation came in softer than expected this week—but markets stayed jumpy.

The Consumer Price Index (CPI) rose just 0.1% in May, with core inflation also up 0.1%, marking the smallest increase since 2021.

It was good news on paper.

Yet instead of a clean rally, we saw cautious moves in stocks and 10-year Treasury yields easing about 4 basis points, holding near 4.4%.

Meanwhile, a new Moody’s report warned of rapid inflows of retail cash into private equity and private credit—raising red flags about liquidity and transparency risks.

In short: investors are still chasing yield.

But not always where it makes the most sense.

Inflation Is Cooling—But Confusion Isn’t

A cooler CPI should have calmed markets.

Instead, sentiment stayed uncertain.

Rate-cut expectations moved—again.

And while traditional bond ETFs regained some attention, many retail investors are shifting toward complex private-market funds in search of higher returns.

Moody’s flagged concerns about weaker underwriting standards, less transparent pricing, and limited liquidity across these asset classes.

This isn’t just a portfolio shift—it’s a behavior shift.

And it’s happening fast.

Why This Matters for Long-Term Investors

In a high-noise market, clarity matters more than ever.

Bond ETFs aren’t flashy—but they offer structure, liquidity, and pricing visibility.

They can be bought and sold easily. Tracked transparently. Priced daily.

That makes them especially valuable when markets turn volatile.

By contrast, private-market funds now topping $1.4 trillion in assets may not offer that same flexibility when you need it most.

What to Do Now

- Anchor your portfolio with the right fixed-income core

Use diversified bond ETFs (like AGG, BND, or IUSB) to build stability into your allocation - Don’t confuse high yield with smart yield

Private credit may offer double-digit returns—but often with illiquidity and valuation opacity - Align bond duration to your time horizon

Shorter-duration ETFs may reduce rate sensitivity as Fed policy remains in flux - Let bonds steady your behavior, not just your income

Fixed income isn’t just about returns—it’s a ballast that keeps emotional decisions in check - Stick to transparent, scalable investments

Indexable bond exposure is easier to manage, track, and adjust as your goals evolve

Are You Taking Comfort in Liquidity—Or Just Chasing Returns?

If markets pull back again, will you have assets you can rebalance?

Or will you be locked into investments that don’t move when you need them to?

Bonds Aren’t Boring—They’re Your Plan’s Foundation

In an era of AI hype, private-credit promises, and headline-fueled volatility…

It’s easy to overlook the value of simplicity.

But Bond ETFs continue to offer what long-term investors really need:

Clarity. Flexibility. Discipline.

And in markets like these, that’s not just helpful—it’s powerful.

"Retail inflows into private markets surged in early 2025—totaling over $1.4 trillion in assets, according to Moody’s."

Strategies Worth Watching

The 5 Most Profitable Companies in the S&P 500

You’d expect Nvidia to be on the list.

But did you know there are four companies with equally margins?

Measured by net profit margin (TTM)—a key metric for Super Investors—these firms lead the pack in profitability.

Here’s how they stack up:

✅ VICI Properties – 67.8%

✅ CME Group – 57.8%

✅ Visa – 52.8%

✅ Nvidia – 51.7%

✅ VeriSign – 50.2%

These aren’t just big names—they’re businesses with serious pricing power and financial efficiency.

And knowing how to assess margins is just one piece of building a smarter portfolio.

Inside the Super Investor Club, you’ll learn how to find high-quality companies like these—and what to do once you’ve found them.

🔗 Start your free 2-week trial at the Super Investor Club

P.S. No charges during the trial. No pressure to stay. But a lot to gain if you do.

More Tools for Your Journey

Because Investing Isn’t Just About Numbers

When money’s on the line, emotions run high.

It’s easy to get reactive—buying too fast, selling too soon.

What helped me most was having something steady to return to.

Curated newsletters gave me perspective when headlines made me anxious.

They remind you of the bigger picture and why your plan matters.

If you’re looking for a more grounded way to invest, this shortlist might help.