Another Alarm from the Market. Should You React?

How to protect your energy when every headline feels urgent

Another Scare. Another Cycle Begins.

This week’s jobs data surprised — and markets blinked.

The ADP report showed a drop of 33,000 private-sector jobs, the first monthly decline since early 2023.

Yields on 2-year Treasuries dipped slightly as rate-cut speculation crept back in.

Most of the weakness came from services — like professional, business, and healthcare roles — not cyclical sectors like manufacturing or hospitality.

It wasn’t a crisis. But it didn’t need to be.

It still pulled your attention. Again.

What This Really Signals

For long-term investors, the headline isn’t the real problem.

It’s the accumulation of headlines.

Soft payrolls. Sticky inflation. Rate-cut noise. Trade rumors.

Each one nudges your focus. Each one whispers “maybe now.”

Even if you didn’t sell a thing, your mental energy likely shifted.

And that slow erosion of attention? That’s the real threat.

What It Teaches Us

Markets don’t just move your money — they move your mind.

You don’t need to panic to lose your edge.

Just staying constantly on alert — constantly ready to react — can wear you down.

Over time, even disciplined investors start asking the wrong questions.

Not “Is my strategy working?” but “Should I be doing something… right now?”

This is what volatility fatigue looks like.

🛠️ 4 Ways to Stay Focused Without Burning Out

Here’s how to protect your mental edge while staying informed:

- Time-box your attention

You don’t need to track every twitch. Set specific times to review the market — once a week is plenty for most strategies. - Filter your inputs

Choose 3–5 core signals that matter to your process. Let the rest scroll by. - Track reactions — not just returns

A quick note on how you felt during a data drop will teach you more than most news alerts ever will. - Hold ballast positions for mental clarity

Some stocks offer calm. They won’t make headlines — but they help you stay grounded through them.

📋 Watchlist Ideas That Lower the Noise

These aren’t high-drama names — but they reward long attention spans:

• Costco (COST) – Durable demand and pricing power, rarely caught in macro whiplash

• MSCI (MSCI) – Index tools with global reach and low investor chatter

• Vanguard Dividend Appreciation ETF (VIG) – Steady compounders that do the quiet work

“Peace of mind is an investment too.”

A Question to Sit With

Are you managing your focus — or letting the market manage it for you?

You Don’t Have to Be Always On

This week’s labor scare will pass — just like the last one.

Your job isn’t to react to every ripple.

It’s to protect your clarity, preserve your stamina, and stay ready for when real opportunities emerge.

Midweek markets can feel noisy. But that doesn’t mean you need to listen.

You’re still in control.

And you’re still in the game.

Strategies Worth Watching

How to Cut Through Financial Noise in Just 7 Minutes

Market headlines will keep coming.

But clarity doesn’t come from tracking more news—it comes from sharpening your process.

Inside the Super Investor Club, members use a 7-minute financial statement review to stay focused on what actually matters.

No hype. No guesswork. Just repeatable filters to anchor your watchlist.

Here’s how it works:

✅ Minute 1 – Read the CEO letter for real strategy, not spin

✅ Minute 2 – Scan the income statement for margin strength

✅ Minute 3 – Assess balance sheet stability and debt levels

✅ Minute 4 – Check if cash flow is real or just numbers

✅ Minute 5–7 – Review dividends, audit flags, and segment growth

This process helps you focus your attention on signal—not noise.

It’s a favorite tool for long-term investors who want to protect their mental energy and their returns.

👉 Try Super Investor Club with a free 2-week trial

P.S. There’s no commitment. Cancel anytime during your trial.

More Tools for Your Journey

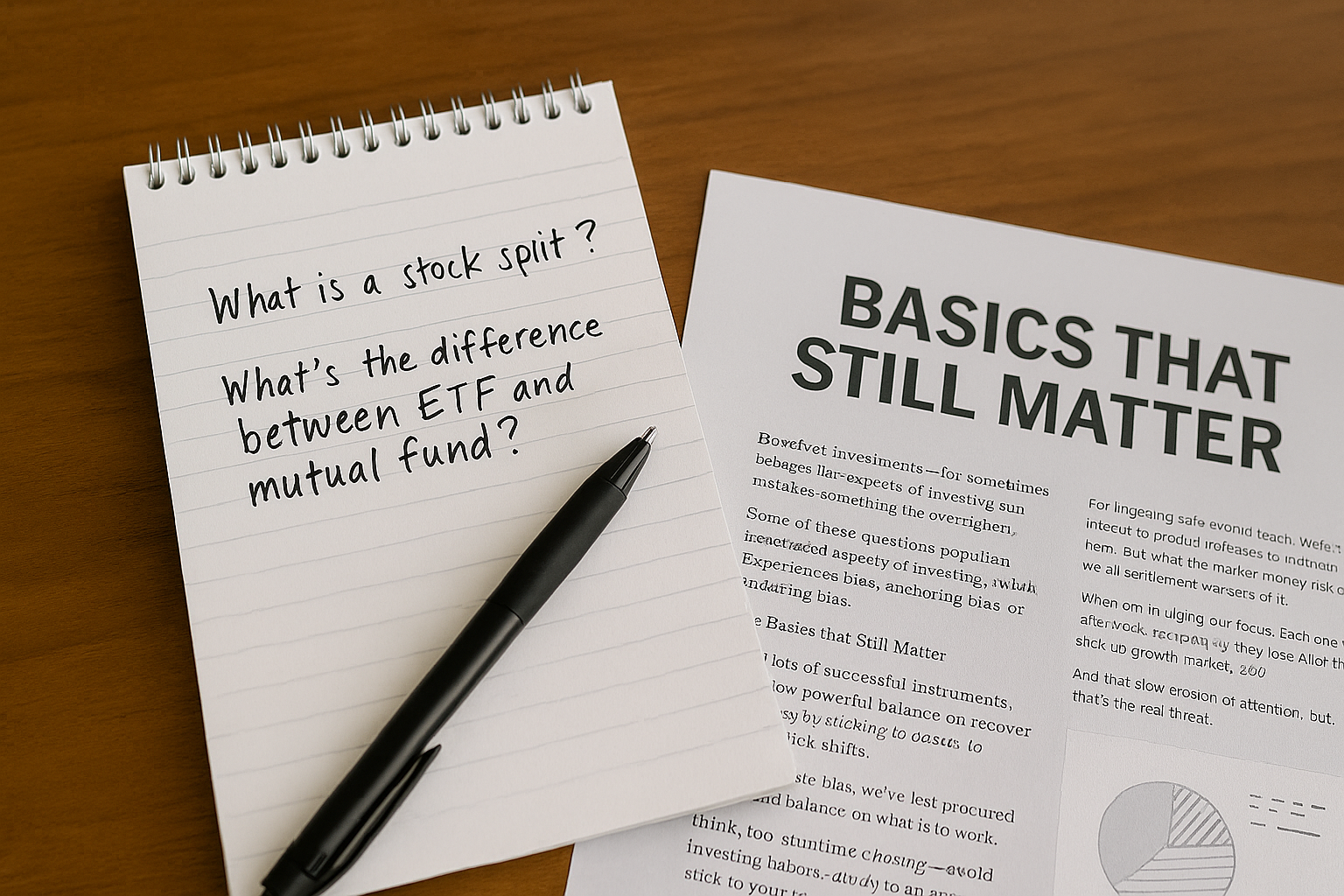

Clarity Starts With Better Questions

It’s easy to feel overwhelmed when headlines keep shifting the ground under your feet.

You start wondering what others already know — and whether your questions sound “too basic.”

That’s where curated newsletters can help.

They explain what matters, why it matters, and how to think through it.

You don’t have to keep up with every twist in the market.

You just need a steady place to build understanding without the pressure to perform.

If that sounds like a relief, this shortlist might help.